An Unbiased View of Eb5 Investment Immigration

Table of ContentsSome Ideas on Eb5 Investment Immigration You Should Know6 Simple Techniques For Eb5 Investment ImmigrationThe 9-Minute Rule for Eb5 Investment Immigration9 Easy Facts About Eb5 Investment Immigration DescribedEb5 Investment Immigration Things To Know Before You Get This

While we strive to use precise and current material, it needs to not be taken into consideration legal guidance. Immigration legislations and regulations are subject to alter, and private circumstances can vary extensively. For personalized guidance and lawful suggestions concerning your particular migration scenario, we strongly suggest seeking advice from with a certified immigration attorney that can supply you with customized help and ensure conformity with existing regulations and guidelines.

Citizenship, via financial investment. Currently, since March 15, 2022, the quantity of investment is $800,000 (in Targeted Work Locations and Rural Locations) and $1,050,000 elsewhere (non-TEA areas). Congress has actually accepted these quantities for the following five years beginning March 15, 2022.

To receive the EB-5 Visa, Capitalists must create 10 permanent united state work within two years from the date of their complete investment. EB5 Investment Immigration. This EB-5 Visa Demand ensures that financial investments contribute directly to the united state job market. This applies whether the work are created straight by the industrial venture or indirectly under sponsorship of a marked EB-5 Regional Facility like EB5 United

An Unbiased View of Eb5 Investment Immigration

These work are established via models that make use of inputs such as advancement expenses (e.g., building and devices costs) or yearly profits generated by recurring procedures. On the other hand, under the standalone, or straight, EB-5 Program, just direct, permanent W-2 worker settings within the business enterprise may be counted. An essential danger of depending exclusively on direct workers is that staff decreases because of market problems can lead to insufficient permanent settings, potentially causing USCIS denial of the capitalist's application if the task development requirement is not fulfilled.

The financial model then projects the variety of direct work the brand-new organization is most likely to create based on its awaited revenues. Indirect work calculated through economic versions describes employment you could try here produced in sectors that provide the goods or services to the business straight involved in the task. These work are produced as a result of the raised need for items, products, or services that sustain the business's operations.

The Best Guide To Eb5 Investment Immigration

An employment-based fifth choice category (EB-5) financial investment visa gives an approach of becoming a permanent united state citizen for international nationals wanting to spend resources in the United States. In order to request this permit, an international capitalist needs to invest $1.8 million (or $900,000 in a Regional Center within a "Targeted Employment Area") and create or protect a minimum of 10 full time tasks for United States employees (leaving out the capitalist and their immediate household).

Today, 95% of all EB-5 capital is elevated and spent by Regional Centers. In numerous areas, EB-5 financial investments have actually filled up the financing space, offering a new, essential resource of capital for local economic development projects that renew areas, develop and support work, infrastructure, and solutions.

What Does Eb5 Investment Immigration Mean?

Even more than 25 countries, consisting of Australia and the United Kingdom, use similar programs to attract foreign investments. The American program is a lot more stringent than many others, requiring significant risk for these details financiers in terms of both their financial investment and migration condition.

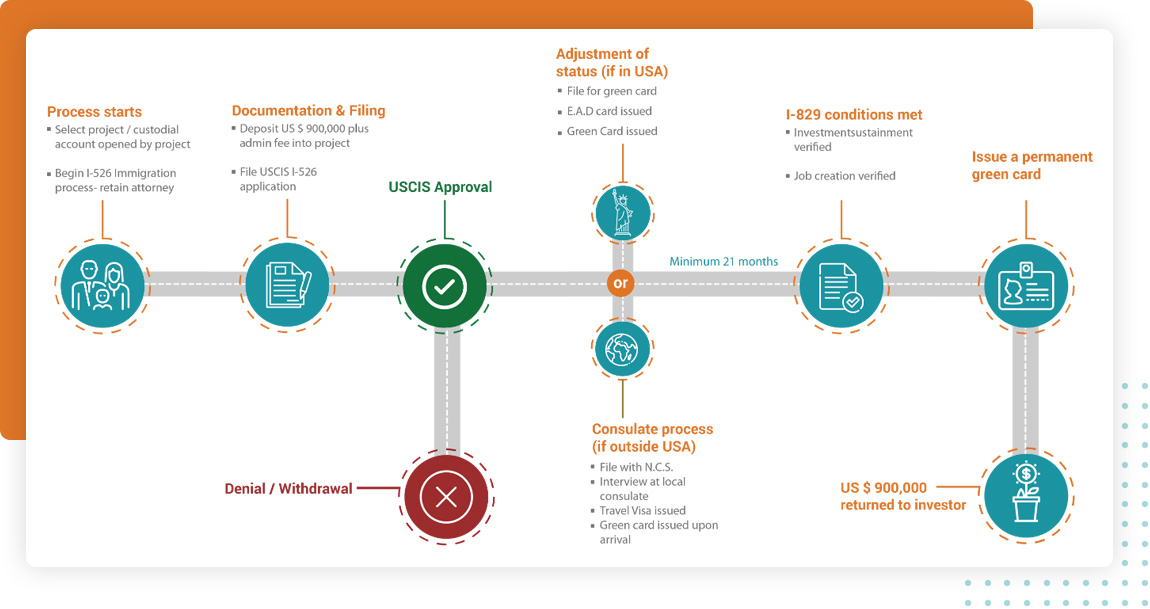

Family members and people that look for to relocate to the United States on a permanent basis can apply for the EB-5 Immigrant Financier Program. The United States Citizenship and Immigration Solutions (U.S.C.I.S.) established out numerous requirements to obtain permanent residency through the EB-5 visa program.: The first step is to discover a qualifying investment chance.

Once the chance has been determined, the financier should make the financial investment and send an I-526 application to the united state Citizenship and Migration Solutions (USCIS). This request should include evidence of the financial investment, such as financial institution declarations, purchase agreements, and company plans. The USCIS will certainly assess the I-526 application and either authorize it or request extra evidence.

All about Eb5 Investment Immigration

The financier has to apply for conditional residency by submitting an I-485 petition. This application needs to be submitted within six months of the I-526 authorization and have to consist of proof that the financial investment was made which it has created at the very least 10 full-time tasks for united state employees. The USCIS will evaluate the I-485 application and either authorize it or demand extra proof.